Gain Entry to an Investment Class Typically Accessible Only to Ultra-High Net Worth Individuals

Unlock an exclusive investment opportunity traditionally reserved for ultra-high net worth individuals: Reinsurance.

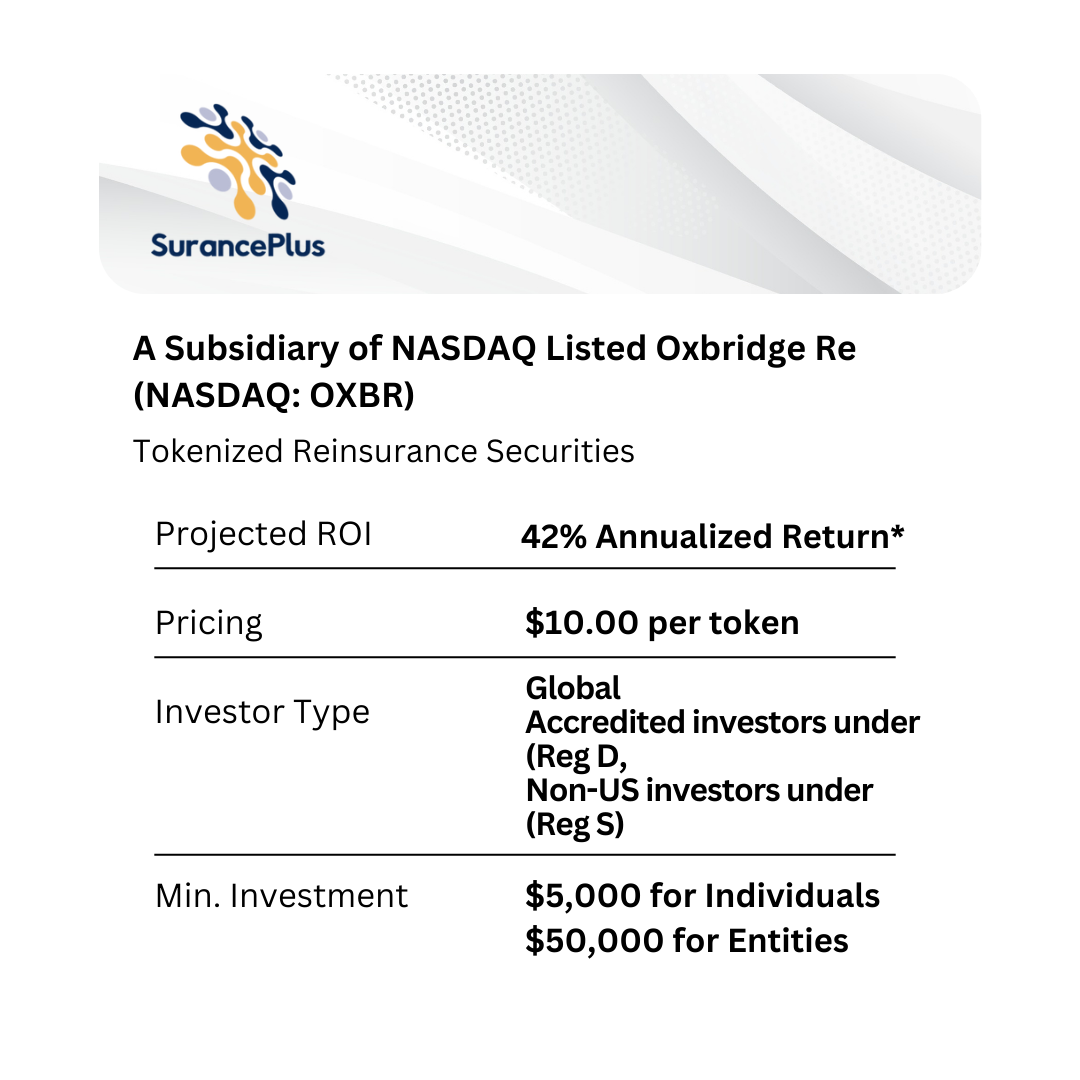

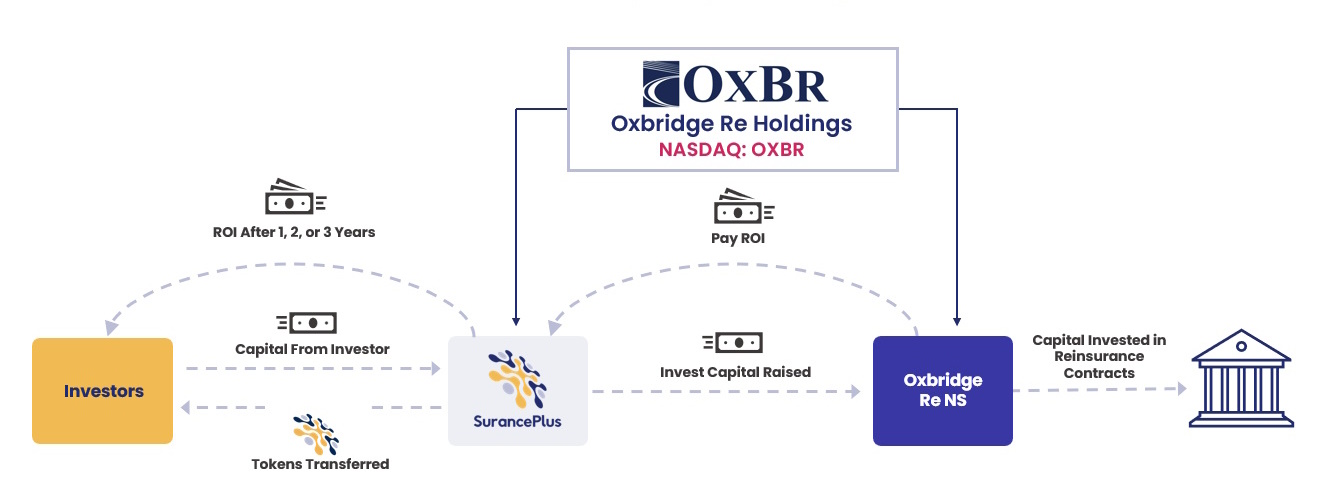

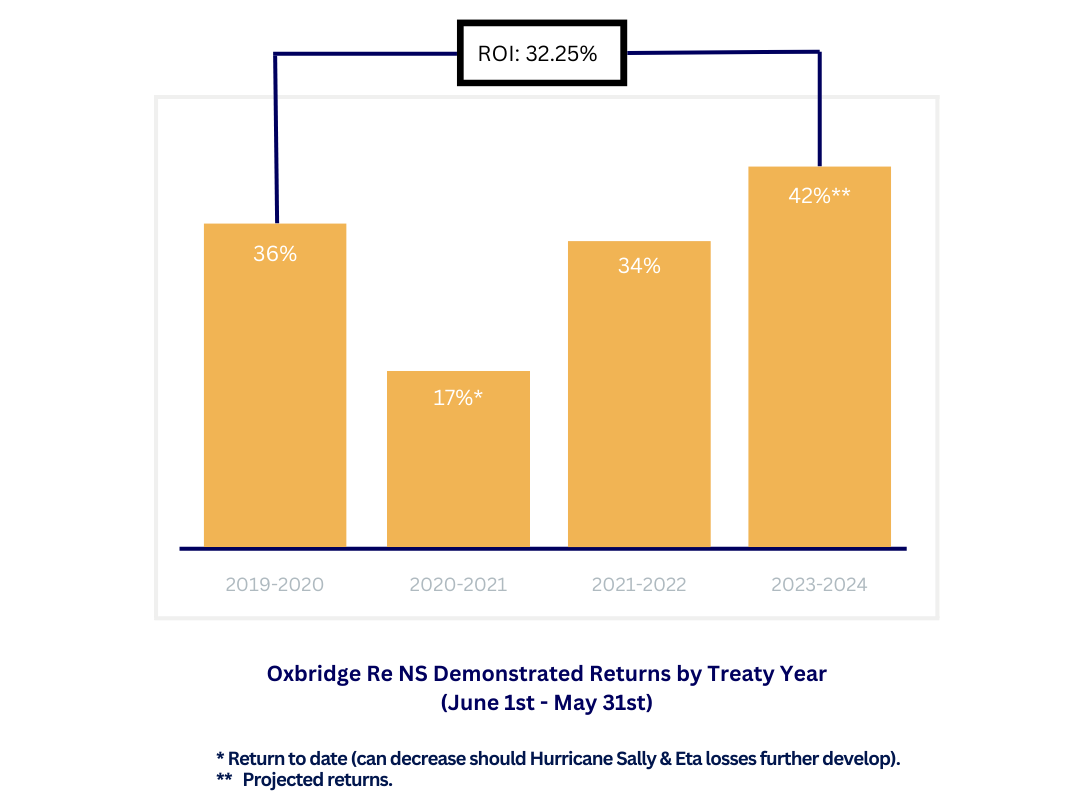

Secure an targeted 20% or 42% annualized return by investing in a high-yield reinsurance contract pool with SurancePlus, a subsidiary of the NASDAQ-listed Oxbridge Re.

Reserve your seat at the table by booking a call today.

Where Innovation Finds

Investment.

Why Choose Us

Asset-Backed Investment Security

Complies with U.S. Securities Laws

The EpsilonCat Re token will be offered and sold to U.S. investors in compliance with exemptions from registration provided under United States securities laws.

Asset-backed

The tokenized reinsurance securities are backed by RWAs (reinsurance contracts) that comply with applicable U.S. securities laws. Monies are held in US Bank Trust accounts that are not exposed to fluctuations in the capital markets.

Attractive ROI

Holders of this year's EpsilonCat Re are projected to receive a targeted 20% or 42% annualized return.*

Transparency and Compliance

SurancePlus is a wholly-owned subsidiary of Oxbridge Re Holdings (NASDAQ: OXBR), a publicly traded company that is audited to Public Company Accounting Oversight Board (PCAOB) standards.

Tokenized Reinsurance Securities

Opportunity Details

Why EpsilonCat Re

Invest in a Real-World Asset

with SurancePlus

Exclusive Investment Access

Gain access to an investment opportunity that has traditionally only been accessible to ultra-high net worth individuals.

Profitable Reinsurance Ventures

Earn an estimated 20% or 42% ROI when you invest with SurancePlus, a subsidiary of NASDAQ-listed Oxbridge Re, in reinsurance contracts (insurance for insurance companies). Examples of large reinsurers are Berkshire Hathaway, and Lloyds of London.

Non-Correlated Opportunities

Proven Track Record

Investors in last year’s 2023 opportunity, DeltaCat Re, are on track to receive a 20% or 42% annualized return on their investment, as filed with the United States Securities and Exchange Commission (SEC).

What is Reinsurance?

Put simply, reinsurance is insurance for insurance companies. It is a $700 billion industry.

Insurance companies purchase reinsurance to reduce risks associated with the occurrence of exceptional, catastrophic events, such as hurricanes, that could expose them to significant losses and potentially put them out of business.

The Best Part?

It’s Non-Market Correlated

Now more than ever, investors need financial products that are uncorrelated to the volatility of this current macro-economic backdrop. Reinsurance presents a great alternative investment opportunity that is decoupled from the fluctuations of the capital markets.

Why is it decoupled? Investments in reinsurance are impacted by exceptional catastrophic events like hurricanes. These are not directly correlated to the events originating on the stock market. With SurancePlus by Oxbridge Re, capital invested in reinsurance is deposited into U.S. bank trust accounts alongside insurers’ premiums to fully collateralize reinsurance contracts with no market exposure.

Invest as little as $5,000 and earn an annualized 20% or 42% Return*

When you invest, you will be grouped with other investors and your investment secured in trust accounts at U.S. banks. Our track record is impeccable. In fact, we closed a round in 2023 of $2.4m, and as you can see in the correlated image, our returns speak for themselves. Refer to the PPM to learn more about how licensed reinsurer Oxbridge Re NS deploys the capital received from SurancePlus in reinsurance contracts.

Built on Transparency and Compliance

What others are saying about SurancePlus

Sign Up on Our Investor Portal

Making an investment is simple.

Visit our easy-to-use Investor Portal to download and read the offering documents. Then, complete your investment with as little as $5,000!

This Investment Has A Limited Time Open Window and Time to Invest is Running Out.

Meet the Leadership Team

Jay Madhu

Chairman, CEO & Director of Oxbridge Re

(NASDAQ: OXBR) | President of SurancePlus

Jay serves as Chairman of the Board, Chief Executive Officer and President of Oxbridge Re Holdings (NASDAQ: OXBR), as well as its licensed reinsurance subsidiaries and its Web3 startup SurancePlus that democratizes reinsurance contracts by issuing digitized securities. Jay is also a founder, Chairman and President of Oxbridge Acquisition Corp. (NASDAQ: OXAC) and founder/director of HCI Group (NYSE: HCI).

Wrendon Timothy

CFO & Director of Oxbridge Re

(NASDAQ: OXBR) | Director of SurancePlus

Common Questions

Most Popular Questions

No.

EpsilonCat Re is not a cryptocurrency.

It is a Real-World Asset (RWA) backed security, compliant with U.S. Securities law, that has been digitized to provide easier access to investors.

The assets backing the security are fully collateralized reinsurance contracts underwritten by Oxbridge Re’s regulated reinsurance subsidiaries.

No.

SurancePlus has hired an SEC-registered transfer agent to provide a simple Investor Portal where investors can download the offering documents, sign their subscription agreements, view wire transfer details, transfer investment funds to SurancePlus, and monitor their investments without needing to own a digital wallet.

However, tech-savvy investors who wish to self-custody their tokens can still use their ERC-20 or WalletConnect compatible wallet by registering it in the Investor Portal.

Yes.

The offering is available to U.S. accredited investors under Rule 506(c) of SEC Regulation D of the U.S. Securities Act of 1933, as amended.

Yes.

The offering is available to non-U.S. persons under Regulation S of the Securities Act of 1933, as amended.

Yes.

Prospective investors from the United States must complete accreditation verification checks in accordance with SEC Regulation D of the US Securities Act of 1933, as amended.

Yes.

No.

EpsilonCat Re is not an NFT.

No.

EpsilonCat Re is not a utility token.

Yes.

The EpsilonCat Re digital security is implemented as an ERC-20 token.

SurancePlus has hired a United States Securities and Exchange Commission SEC-registered transfer agent which will maintain records of the ownership of issued securities in Traditional Book Entry (TBE) form.

The ownership of issued EpsilonCat Re tokens will also be recorded on the Avalanche blockchain network.

No.

The SEC-registered transfer agent hired by SurancePlus will maintain records of the ownership of issued securities.

However, investors that wish to self-custody their digital securities can use their ERC-20 or WalletConnect compatible wallet.

No.

At present the Investor Portal does not allow the use of stablecoins. This might change soon. In the interim, payments for investments must be made via wire transfer.

Yes.

Oxbridge Re, parent company of SurancePlus, is a publicly traded company listed on the NASDAQ under ticker symbol OXBR.

Oxbridge Re’s company information and filings can be found on the SEC’s website here: Oxbridge Re SEC filings.

The SEC filing for EpsilonCat Re can be found here: Oxbridge Re Form 8-K for EpsilonCat Re Offering